FAQ

1. Create an Account on our Investor Portal- https://partner.avestorinc.com/login/YieldShire

2. Review the Fund Offering Summary

3. Commit Investment Capital Amount

4. Review and sign Private Placement Memorandum (PPM)

5. Wire / Deposit Investment Fund

6. Receive Confirmation Documents

Yes, our investment platform is an industry leader in investor security. The platform offers security features such as:

Two-Factor Authentication

24x7 Monitoring and Alerting

SSL Certificates

Encrypted Data Transmission End to End

PCI DSS Certified Infrastructure

YieldShire offerings are open to accredited and non-accredited investors.

Our offerings are structured under SEC Rule 506(b) of Regulation D.

A minimum capital contribution of $50,000 is required.

See “Terms of the Offering.” in the PPM by creating an account here: https://partner.avestorinc.com/login/YieldShire

Yes, we accept investments from a self-directed IRA account from registered custodians.

We are currently not participating in EB-5 Investor Program.

Acquisition of or investment in value-add multi-family residential real estate assets in Jersey City and New York City.

The Company directly purchases and/or invests in various forms of real estate assets located in New Jersey and New York. These assets will include residential properties, apartment complexes, and smaller commercial real estate properties.

The Company will also extend short-term loans in first or second-lien positions to other businesses and individuals to enable them to renovate or do ground up construction on real estate projects.

Not directly. 1031 exchanges can be structured through Delaware Statutory Trusts (DSTs)

Schedule a call with Abhi to discuss further- https://YieldShire.com/chat.html

We offer Equity and Debt deals.

Investors can choose and allocate based on their preferences and expectation from the projected returns.

To view Current offering, create an account at: https://partner.avestorinc.com/login/YieldShire

Yieldshire invests directly as General Partner. Our vertically integrated model allows Yieldshire to charge lower fees, potentially providing greater returns to our investors. Typically, investors benefit from a higher preferred return, lower management fee, or a % of the carried interest which passes through to the fund.

Yieldshire as the manager is compensated via a 1% acquisition fee, 1% asset management fee, and performance fees % of carried interest (that varies with deal/offering)

To view current offerings, please create an account and review PPM for full details: https://partner.avestorinc.com/login/YieldShire

We offer an investment platform with a self-serve investor portal. Pictures from the ground and periodically uploaded to the portal.

We communicate and provide regular updates on projects.

Investors also have the ability to generate investment reports and download all offerings and tax documents(K-1 form) directly through the platform.

Our investor portal allows investors to track their investments across different profile types like their LLC, IRA, Trust, or as an Individual.

1. We are equity partners in all our deals.

2. We understand that not every investor is the same, each has unique investment needs and preferences, so we provide our investors the flexibility and the option to select from deals, and the amount they want to allocate to those deals.

3. Our investors have the option to invest in equity and/or debt(fixed income) offerings.

4. Our vertically integrated company helps us streamline processes, have faster execution, and have higher profits for our investors.

5. Seamless onboarding and complete paperless experience

- - Investors receive automated-debit distributions into their bank account.

- - Single K-1 form for all investments uploaded to the secure investor portal.

6. Our mantra is to keep it real ,keep it simple. We do that with open and transparent communication and projections that are grounded in reality.

Please reach out to our team directly via email at Info@YieldShire.com or call us at 888 681 7558

Finding deals, doing due diligence, and underwriting.

As a passive investor, you don't have to constantly look for deals, do your underwriting, negotiate prices, and close deals. We at Yieldshire do these things in-house.

Development and project management

As a passive investor, you don't have to deal with the contractors, architects, building departments, city, etc. Our vertically integrated team at Yieldshire ensures timely execution.

Dealing with the 3 T's of active property management

As a passive investor, you don't have to deal with the three Ts of active management - tenants, toilets, and trash.

100% of tax benefits

As a passive investor, 100% of the tax benefits get passed to you.

Payout

Lump sum return at time of sale or refinance

Value Add- Forced Appreciation

Add value to real estate by constructing or renovating, which also helps contribute to improving localities and benefits the growth of communities.

Cashflow

Tenants pay monthly rent which covers all expenses and provides profit to the owners/partners.

Inflation

US inflation is around 8%, and investing in assets like real estate works in your favor, as prices increase, the value of your property goes up as well.

Cash steadily loses value

Inflation eats away at the purchasing power of cash. Because of that and the low yield of cash assets, cash steadily loses value. The time value of money, because of inflation and other factors, cash is worth more now than it will be in the future.

Flexibility

Provides the option to invest in debt or equity deals. Learn more about our equity and debt offerings at- https://partner.avestorinc.com/login/YieldShire

Real Estate Vs. Stocks

Real estate is less volatile than stocks, whose value can rise or fall more quickly. But real estate is less liquid than stocks: It's easier to sell your stocks and gain access to your money than it is your real estate investments.

Real Estate Vs. Bonds

Bonds are one of the safer investments. You usually won't lose money by investing in them. Their gains tend to be smaller, though. You have the chance to make higher gains by investing in real estate, though your risk of losing money is also higher.

Real Estate Vs. CDs

Investing in CDs is similar to investing in bonds: These are among the safest of investments, and it's rare to lose money when investing in them. But like bonds, your gains are generally lower than what you might earn when you invest in real estate.

Real Estate Vs. Mutual Funds

Mutual funds are a long-term investment. Generally, if you hold onto your mutual fund investments long enough, they'll increase in value, though appreciation is not guaranteed. Like with stocks, it's easier to invest in mutual funds than in real estate. Real estate investments, though, can provide a hedge against the economic downturns that can cause mutual fund investments to fall in value.

A Cost Segregation Study is an engineer-based study of all of the individual assets purchased in a real estate transaction. This allows the taxpayer to use an accelerated depreciation schedule resulting in higher tax deductions in the early years of the purchase of a property - keeping more dollars in the business.

The goal of a cost segregation study is to identify all property-related costs that can be depreciated over five, seven and 15 years—or written off faster using bonus depreciation, which is 100% through 2022.

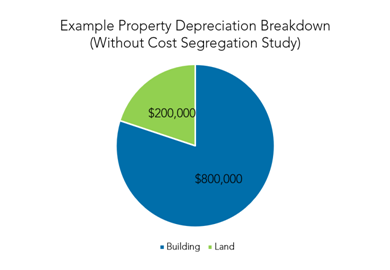

For example: You buy an office building for $1,000,000. Land isn't depreciable, so you decide the land is worth $200,000, and the building is worth $800,000.

If you depreciate the building over 39 years, your depreciation write-off would be $20,512.82 per year. Assuming a 37% federal income tax rate, that would save you roughly $4,600 in taxes.

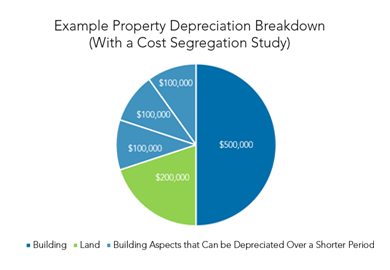

Now, let's say you decide to get a cost segregation study. After completing the study, your advisory team identifies the following costs:

$100,000 of interior fixtures and finishes that can be depreciated over five years

$100,000 of interior fixtures that can be depreciated over seven years

$100,000 of land improvements that can be depreciated over 15 years

Based on the study, $300,000 of the $800,000 building is eligible for bonus depreciation, so 100% of the cost could be written off in 2021. Assuming a 37% tax rate, that would result in tax savings of $108,153 over depreciating the building with no cost segregation (($312,820.51 - $20,512.82) x 37%).

However, even if you didn’t take advantage of bonus depreciation, those items could be depreciated over a shorter recovery period using an accelerated depreciation method. As a result, your estimated first-year depreciation write-off would be:

Building ($500,000 / 39 years): $12,820.51

5-year property ($100,000 / 5 years): $20,000

7-year property ($100,000 / 7 years): $14,285.71

15-year property ($100,000 / 15 years): $5,000

Total first-year depreciation expense: $52,106.23

So even if you didn't take advantage of bonus depreciation, your first-year depreciation write-off would result in a tax savings of $11,689.56 over depreciating the building over 39 years with no cost segregation (($52,106.23 - $20,512.82) x 37%).